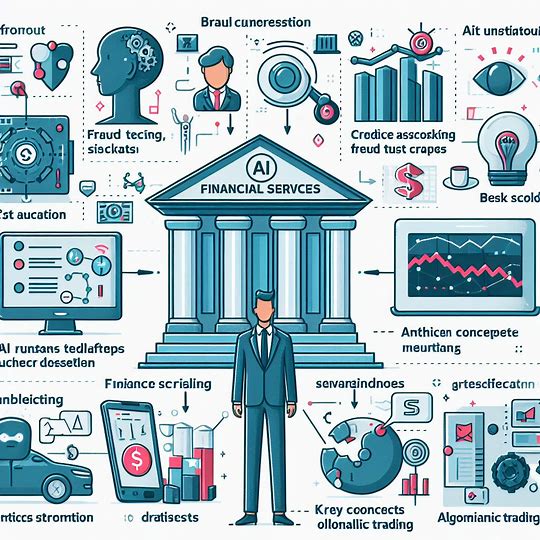

AI Revolution Reshaping the Financial Sector: A Transformative Force

Explore how AI technologies are revolutionizing the financial sector, driving innovation across risk management, fraud detection, customer service, trading, credit scoring, personalized advice, compliance, and operational efficiency in this comprehensive analysis.

Introduction

As an esteemed professor at the Massachusetts Institute of Technology (MIT) with over three decades of experience in technical writing, I have witnessed firsthand the transformative power of artificial intelligence (AI) across various industries. However, the impact of AI on the financial services sector has been particularly profound, revolutionizing the way institutions operate and deliver services to their clients.

In this article, we delve into the key areas where AI is making a significant impact, reshaping the financial landscape and driving innovation at an unprecedented pace. Buckle up, for this exploration will not only shed light on the current applications but also provide insights into the future trajectory of AI in finance.

1. Risk Management: Harnessing the Power of Predictive Analytics

Financial institutions have long grappled with the challenge of effectively managing risks associated with investments, lending, and other financial products. Enter AI and its powerful predictive analytics capabilities. By leveraging machine learning models trained on vast amounts of historical data and market trends, financial firms can now access and mitigate risks with enhanced accuracy and foresight.

These AI-driven risk management systems continuously analyze a multitude of factors, including economic indicators, geopolitical events, and market fluctuations, to identify potential threats and opportunities. The insights gleaned from these analyses enable financial institutions to make informed decisions, adjust their strategies proactively, and maintain a robust risk profile.

Moreover, AI algorithms can simulate various scenarios and stress-test portfolios, providing invaluable insights into the potential impact of adverse events. This proactive approach empowers financial institutions to navigate market uncertainties with greater confidence and agility.

2. Fraud Detection and Prevention: Safeguarding Financial Integrity

The ever-evolving landscape of financial fraud poses a significant threat to the integrity and trust of the financial sector. AI’s pattern recognition and anomaly detection capabilities have emerged as a powerful line of defense against fraudulent activities.

By leveraging machine learning algorithms trained on vast datasets of historical transactions and fraud patterns, financial institutions can identify anomalies and suspicious behavior with unprecedented accuracy. These AI systems continuously monitor transaction data, analyzing factors such as location, device information, transaction amounts, and user behavior patterns to detect potentially fraudulent activities in real-time.

Moreover, AI systems can adapt and evolve as new fraud tactics emerge, ensuring a proactive approach to safeguarding financial assets and protecting customer interests. This heightened security not only prevents financial losses but also fosters trust and confidence in the financial ecosystem.

3. Customer Service and Chatbots: Elevating the User Experience

In the fast-paced world of finance, providing exceptional customer service is paramount. AI-powered chatbots and virtual assistants have revolutionized how financial institutions interact with their customers, offering personalized support and accessibility like never before.

Leveraging natural language processing (NLP) and conversational AI technologies, these intelligent systems can understand and respond to customer queries in a human-like manner. Whether it’s answering common questions, providing account information, or guiding customers through complex financial processes, AI-driven chatbots and virtual assistants offer a seamless and efficient experience.

Furthermore, these AI solutions can analyze customer interactions and feedback to continuously improve their response accuracy and personalization capabilities. This not only enhances the overall customer experience but also frees up human resources to focus on more complex tasks, fostering operational efficiency and customer satisfaction.

4. Algorithmic Trading: Harnessing the Speed of AI

In the high-stakes world of financial markets, speed and agility are crucial. AI has become an indispensable tool in algorithmic trading, enabling financial institutions to execute transactions at lightning-fast speeds and capitalize on fleeting market opportunities.

AI algorithms, trained on vast amounts of market data and historical trends, can analyze intricate patterns, identify profitable trade opportunities, and execute trades autonomously, all within milliseconds. This level of speed and responsiveness is simply unattainable for human traders, providing a significant competitive edge to financial firms that embrace AI-driven trading strategies.

Moreover, AI algorithms can continuously adapt and optimize their trading strategies based on real-time market conditions, ensuring a dynamic and resilient approach to navigating the ever-changing financial landscape.

5. Credit Scoring and Underwriting: Personalized Assessments

In the realm of credit and lending, AI is revolutionizing the way financial institutions assess creditworthiness and make underwriting decisions. Traditional credit scoring methods, which heavily rely on limited data sources such as credit reports and income statements, are being augmented by AI’s ability to analyze a broader range of data points.

AI algorithms can incorporate non-traditional data sources, including social media behavior, geolocation data, and purchase patterns, to gain a more comprehensive understanding of an individual’s financial behavior and creditworthiness. This holistic approach enables financial institutions to make more accurate and personalized credit assessments, reducing the risk of defaults and fostering financial inclusion.

Furthermore, AI-driven underwriting processes streamline the decision-making process, enabling faster loan approvals and enhancing the overall customer experience.

6. Personalized Financial Advice: Tailored Solutions for Every Client

In the ever-evolving financial landscape, providing personalized advice and recommendations is crucial for meeting the unique needs and goals of each client. AI’s ability to analyze vast amounts of data, including individual financial behaviors, preferences, and life events, has paved the way for highly tailored financial advisory services.

AI algorithms can process and interpret complex financial data, market trends, and regulatory changes, and then provide clients with personalized investment recommendations, budgeting strategies, and financial planning advice. This level of customization ensures that clients receive guidance that aligns with their specific goals, risk tolerance, and life circumstances.

Moreover, AI-driven advisory services can continuously adapt and evolve as client circumstances change, offering real-time updates and adjustments to financial plans, ensuring that clients remain on track to achieve their desired outcomes.

7. Regulatory Compliance: Navigating Complex Requirements

The financial sector is subject to a complex web of regulations and compliance requirements, which can be a significant burden for institutions to navigate. AI has emerged as a powerful tool to streamline and automate compliance processes, ensuring that financial firms operate within the boundaries of applicable laws and regulations.

Machine learning models can be trained to analyze vast amounts of regulatory data, interpret complex rules and guidelines, and identify potential compliance risks or violations within financial transactions and operations. These AI systems can continuously monitor and flag any anomalies or non-compliant activities, enabling financial institutions to take corrective actions promptly.

Furthermore, AI-driven compliance solutions can adapt and evolve as regulations change, ensuring that financial firms remain up-to-date and compliant with the latest regulatory requirements. This proactive approach not only mitigates legal and financial risks but also enhances trust and transparency within the financial ecosystem.

8. Automation of Back-Office Operations: Enhancing Efficiency and Accuracy

Financial institutions often grapple with the challenge of managing high volumes of routine back-office tasks, such as data entry, document processing, and reconciliation. AI has revolutionized this aspect of financial operations by enabling the automation of these labor-intensive processes.

Intelligent automation solutions, powered by AI technologies like machine learning, natural language processing, and computer vision, can accurately extract data from various sources, classify and process documents, and reconcile accounts with minimal human intervention. This not only reduces the likelihood of errors and inconsistencies but also frees up valuable human resources to focus on more strategic and value-added tasks.

Moreover, AI-driven automation solutions can continuously learn and adapt to process changes, ensuring seamless integration with evolving operational workflows and reducing the need for manual updates and modifications.

9. Insurance Underwriting and Claims Processing: Streamlining Operations

The insurance sector has long been a prime beneficiary of AI’s capabilities. In the realm of underwriting, AI algorithms can analyze vast amounts of data, including historical claims, risk factors, and customer profiles, to assess risks accurately and determine appropriate policy pricing.

By leveraging machine learning models trained on this wealth of data, insurance companies can make more informed underwriting decisions, mitigating potential losses and enhancing profitability.

Furthermore, AI has revolutionized claims processing by automating the evaluation and validation of claims submissions. Intelligent systems can analyze claim documents, detect potentially fraudulent activities, and streamline the entire claims handling process, leading to faster payouts and improved customer satisfaction.

10. Blockchain and Cryptocurrencies: AI Meets Decentralized Finance

While not exclusive to AI, the integration of AI with blockchain technology and cryptocurrencies is an area of significant exploration and innovation. AI algorithms can enhance the security and transparency of blockchain networks by identifying and preventing fraudulent activities, such as double-spending or illegal transactions.

Additionally, AI can play a crucial role in automating and optimizing smart contracts, enabling more efficient and accurate execution of decentralized finance (DeFi) protocols. This symbiotic relationship between AI and blockchain technology holds immense potential for revolutionizing the financial sector, fostering trust, transparency, and efficiency in financial transactions.

Moreover, AI can be leveraged for predictive analytics and market forecasting in the realm of cryptocurrencies, providing investors and traders with valuable insights into market trends and potential investment opportunities.

Conclusion:

As we’ve explored, AI is no longer a futuristic concept but a transformative force reshaping the financial sector in profound ways. From enhancing risk management and fraud detection to streamlining operations and delivering personalized advisory services, AI’s impact is pervasive and far-reaching.

Financial institutions that embrace AI technologies and integrate them into their operations will undoubtedly gain a competitive edge, enabling them to navigate the ever-changing financial landscape with agility, efficiency, and a client-centric approach.

However, it is crucial to acknowledge that the adoption of AI in finance is not without its challenges. Ethical considerations, such as data privacy, algorithmic bias, and transparency, must be carefully addressed to ensure the responsible and trustworthy deployment of these powerful technologies.

As we look towards the future, it is evident that the AI revolution in finance is just beginning. With continued advancements in AI research and development, we can expect even more innovative applications that will reshape the way we interact with financial services.

As an esteemed professor at MIT, witnessing and contributing to this profound transformation has been a truly exhilarating experience. I encourage my colleagues, students, and industry leaders to embrace the power of AI while maintaining a commitment to ethical and responsible practices, ensuring that this technological revolution serves the greater good of society and the financial sector as a whole.